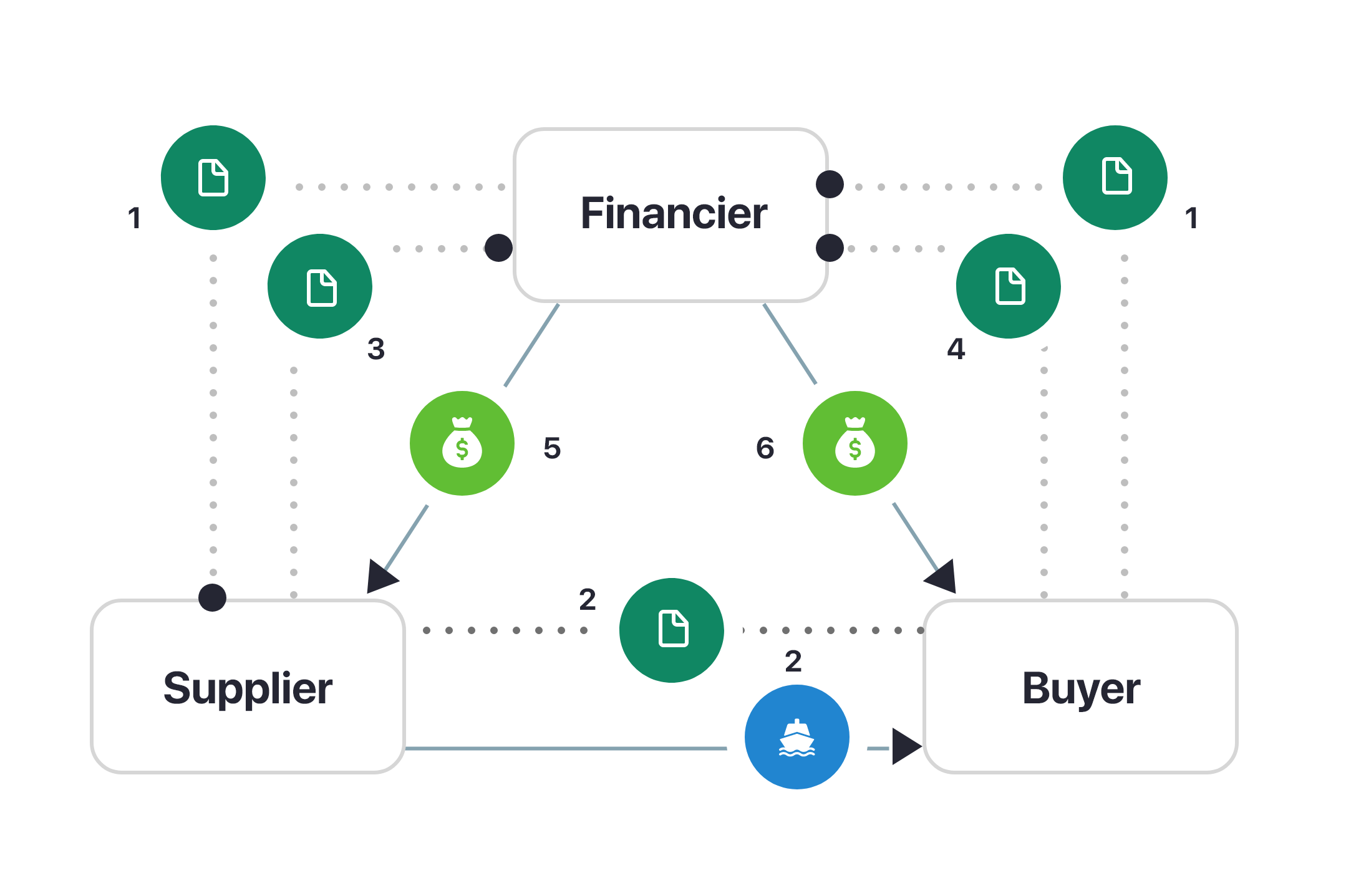

Channel Finance Program

- 1. Supply Chain finance facility agreement entered between buyer(Mizuho Capsave Finance Pvt Ltd customer) and financier

- 2. Goods shipped and sales invoice raised on the buyer (Mizuho Capsave Finance Pvt Ltd customer) by the Corporate

- 3. Corporate submits invoice to Mizuho Capsave Finance Pvt Ltd SCF Platform

- 4. Buyer (Mizuho Capsave Finance Pvt Ltd customer) approves invoice on Mizuho Capsave Finance Pvt Ltd SCF platform

- 5. Mizuho Capsave Finance Pvt Ltd pays the Corporate

- 6. Buyer (Mizuho Capsave Finance Pvt Ltd customer) pays Mizuho Capsave Finance Pvt Ltd on the due date

Channel Finance Program Benefits

- Better WC Management

- Enforces Payment discipline among SME Customers & Distributors / Dealers

- Ascertains greater efficiencies in the Corporate receivable management & reduces collection cost

- Improves Top Line in a disciplined manner

- Facilitates dialogue with Customers / Dealers / Distributors or negotiation of commercial terms

- Supports strategic supplier relation

- Scalability – Supports growth and transactions over a long term period.

- Improves Financial Ratio like ROCE, EVA etc

- Competitive Pricing – Leveraging on Anchor’s credit rating and relationship with bank.

- Reduces dependence on Local Bank

- Simple Standard Documentation

- No collateral required

- Simple Standard documentation

- Seasonal Adhocs with simple documentation and faster TATs