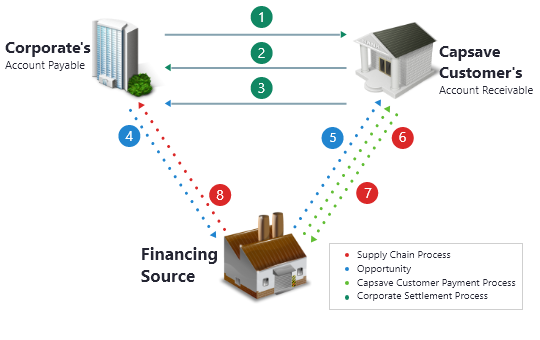

SCF – Vendor Finance (Transaction Flow)

- 1. Corporate issue purchase order

- 2. Capsave Customer Delivers Goods

- 3. Capsave Customer Invoices Buyer

- 4. Corporate approves invoice for payment and send confirmation to bank

- 5. Capsave Customer offered early payment required

- 6. Capsave Customer accepts early payment

- 7. Capsave Finance funds early payment to supplier

- 8. Corporate makes payment on original due date or extends payment terms

Vendor Finance Program Benefits

- Trade Payable to Supplier. Not Bank Debt.

- No Credit Documentation

- No Financing Cost

- Facilitates dialogue with Suppliers for negotiation of commercial terms

- Supports strategic supplier relation

- Scalability – Supports growth in suppliers and transactions over a long term period.

- Improves Cash Flow / Liquidity

- Monetize receivables

- Reduces dependence on Local Bank

- No collateral required

- Competitive Pricing – Leveraging on Corporate ’s credit rating

- Simple Standard documentation

- Encourages vendors to take up new business opportunity without waiting for advances

- Facilitate additional working capital funds